Lowering bills, cutting carbon

In our August 2021 energy prices update, we explain why rocketing wholesale energy prices are causing confusion for households and businesses alike, and what you should do about it.

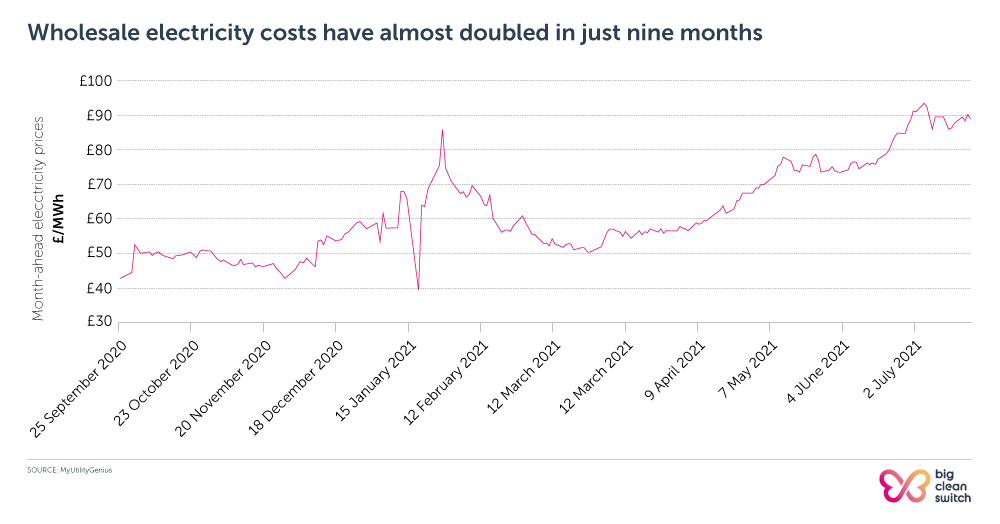

Whichever way you look at it, it’s not a great time to be an energy consumer. The last nine months have seen an almost relentless increase in the price suppliers are paying for the energy they sell to homes and businesses, which is inevitably flowing through into the prices we pay as end users.

The chart below shows ‘month ahead’ electricity prices since September 2020. This is indicative of the price paid by suppliers for the energy they sell to homes and businesses.

High prices are affecting households in two important ways:

We talk about each of these in more detail below.

If you signed up to a fixed rate tariff a year or so ago and are looking for alternatives when the deal comes to an end, the difference between the prices in 2020 and the prices now are particularly stark. By way of example, the cheapest tariff available from one of our consistently competitive suppliers, So Energy, in May 2020 would have cost an average dual fuel household £71.17 a month (this is the average across all regions of the UK). In July 2020, the same amount of energy on So Energy’s cheapest deal will cost £94.19 – a 32% increase.

If you’re looking at a comparison site like Big Clean Switch that aims to save you money, seeing that kind of jump can understandably undermine confidence that you’re going to get a good deal. But remember, it isn’t that our tariffs have got less competitive – it’s just that the rates available a year ago are no longer viable with August 2021 energy prices.

Another area that can cause confusion is estimated savings. We rely on Ofgem guidelines to generate your quote, and it’s important to understand how that works (we’ve written a blog about it, here). If you’re on a fixed rate tariff that ends soon, we have to make an assumption about what will happen next in order to compare what you’ll pay over the next 12 months with our range of suppliers and what you’ll pay if you do nothing and stay with your current provider.

Those words – do nothing – are really important. Most suppliers will drop you onto their default tariff at the end of 12 months, which is usually their most expensive deal. Our site will factor that into your projections, so savings calculations will take into account the fact that your current deal will expire. That can feel counterintuitive – how can we possibly say you’ll be saving money if the deals available now are so much more expensive than the one you’re on? Just remember that the deal you’re on is now a thing of the past – and that if you do nothing, you’re likely to end up paying more when you slip onto your suppliers’ default, or ‘standard variable’ deal.

The final – but possibly the most important – way current prices are affecting households is in savings projections for homes on their suppliers’ standard variable or ‘default’ tariffs. This includes quotes for homes that are on a fixed price deal that ends soon, where we assume you’ll drop onto your supplier’s default tariff when the current one ends – as we explain above. (We’ve written about this issue before, here).

Historically, standard variable tariffs were the money makers for big suppliers, who took advantage of customers’ failure to switch by charging a ‘loyalty penalty’. In response, the energy industry regulator, Ofgem, introduced the a price cap which limits the amount a supplier can charge customers on default tariffs. The price cap is adjusted every six months to reflect changes in the wholesale price of energy.

Since the last price cap was implemented, capping the amount that a dual fuel household paying by direct debit could be charged at £1,138 a year (averaged across all regions of the UK), wholesale prices have jumped enormously. That’s pushed up the fixed price deals that are normally so competitive relative to standard variable tariffs to a level where suppliers are struggling to keep these offers below the price cap.

As a result, customers on default or standard variable tariffs are seeing savings as little as a few pounds when they’re getting their quote, and many are understandably deciding switching isn’t worth the effort. If that’s you, then stop and read on before you make that decision!

Ofgem has recently indicated that the huge wholesale prices we’re seeing currently will result in an increase in the price cap of at least £150, with effect from the beginning of October. At that point, the big suppliers are almost certain to increase their standard variable tariffs in line with the new price cap. So if you’re seeing a saving projection of a few pounds now, that will become tens or even hundreds of pounds one the increase has taken effect.

If you’re coming to the end of your previous energy deal, or already on a variable tariff, your decision needs to come down to how you feel about risk:

Businesses face similar shocks when they’re comparing prices available now with the rates they may have been paying over the last 1-3 years. We’re seeing companies who have had prices fixed for three years facing increases of up to 45% when shopping for a new deal. If that’s you, then remember – there is no price cap on commercial energy, so out of contract rates are the absolute worst case for your business. It’s never been more important to take control of your energy costs by finding a competitive fixed rate deal.

The biggest decision you’ll need to take is how long to commit to current prices.

Shorter, one-year contracts are in general much less competitive at the moment than two- and three- year deals: a sign that energy markets are reasonably confident that current high prices aren’t going to change any time soon. If you don’t mind the risk, you can still take a one-year deal and gamble on lower prices when your renewal comes up, but if your main objective is getting certainty over costs, signing up to a longer-term deal is probably the way to go.

The best thing is always to talk to us – we’ll walk you through your options (including helping you find the lowest cost green options of course) and help you understand what’s best for your organisation.

* ‘Month ahead prices’ are what suppliers pay for energy that will be delivered in a month’s time. Suppliers try to balance risk by forward-buying the energy they know we’ll use as consumers, ensuring they lock in pricing for at least some of the energy they’ll need in the future. That’s how they can then offer fixed price deals to homes and businesses. The further in advance the energy is purchased, the more stable the prices tend to be. Energy bought for delivery the following day tends to show the greatest variability as it’s more affected by short-term factors affecting supply and demand – such as interruptions to supply via interconnectors bringing power from Europe, for example.